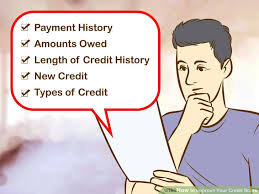

How to improve credit score:

Improve credit score credit report exclude negative information:

since July 1, the country’s three credit reporting agencies will expel and bar certain negative data from credit reports. How to improve credit score credit report exclude negative information. Charge liens and civil debts will never again be accounted for using a loan reports if the negative data does not exclude a client’s name, address and Social Security Number or date of birth.

Whats Means For Us:

Assess liens and common obligations can have an important and negative effect on your FICO rating. As per FICO, in spite of the fact that the effect of a duty lien reduces after some time, its nearness on a credit report is “very genuine.” Varous FICO assessment test systems show that an expense lien could take upwards of 100 focuses off your score, making it hard to get credit or costly in the event that you do.

If you have inadequate assessment lien or common obligation records on your credit report, the evacuation ought to have a significant positive effect on your score. The change should occur on July 1, and you ought to see a prompt lift. Track your Vantage Score for nothing at destinations like Credit Karma. There are likewise various spots where you can locate your free FICO score, including from many charge card organizations that offer the administration to everybody (not only their clients).

Why Is This Happening?

One of the greatest protest classes to the CFPB stays off base data on layaway reports. Under noteworthy weight, the credit revealing offices are putting the weight of verification on the general population and organizations submitting negative data. These progressions are not intended to diminish the negative effect of neglecting to make impose installments. Rather, the progressions are intended to guarantee that lone precise negative data is accounted for to the authorities.

In the event that the CFPB changes settle the inadequacies in those organizations’ operations, purchasers will profit to the tune of possibly billions of dollars, the National Consumer Law Center said.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

You must be logged in to post a comment.