KARACHI: As the daily dollar rate rises, banks have bought twice as much US currency and are sending it abroad on credit cards while the government tries to stop the flow of US dollars out of the country.

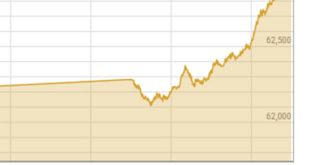

The dollar ended the day at Rs236.84, according to the State Bank of Pakistan (SBP). This was 96 paise more than the previous day’s rate of Rs235.88.

The dollar has a tight hold on the exchange rate, and every day it gets tighter as foreign exchange stocks drop and imports rise.

On Friday, the open market price of the dollar was Rs241, which was pretty much the same as Thursday. Dealers in money said it’s hard to find dollars and other currencies because there is so much demand.

People who work in the currency market told Dawn that the SBP and the government have tight control over buying dollars on the open market, but credit cards give people a way out.

The head of the Exchange Companies Association of Pakistan (ECAP), Malik Bostan, said, “The average amount of money banks bought each week has gone up from $2 to $4 million to $12 million.”

On the open market, it’s very hard for the average person to buy more than $500, but the legal way out has been found. People could bring up to $10,000 with them when they left the country, and credit cards are now very popular.

People who deal in currencies said that the banks’ purchases of dollars have taken dollars off the open market.

Mr. Bostan said, “We have asked the government to cut the limit in half, to $5,000.” For credit cards, he also said that the most you could spend each month should be $2,000.

Dealers in foreign currencies said that the government is trying to increase the country’s foreign exchange savings by limiting spending and borrowing from international lenders. However, credit card withdrawals from banks could hurt the efforts.

Even though the SBP says there are no limits, the buyers said it is hard to open lines of credit for raw materials. An supplier said, “This is being done because the SBP wants to keep the import bill as low as possible.”

A currency trader says that banks are also buying dollars on the black market for a lot more money.

The exchange rate is more vulnerable now that money is leaving through credit cards, which makes the US dollar even stronger in Pakistan.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.