For the first time in over two decades, the euro dropped below 99 cents, and on Monday, worries about rising energy costs and supplies caused the pound to plummet. Russia had stopped supplying gas via its major pipeline to Europe.

In Asia trading, the euro fell to $0.988, its lowest since 2002, while the pound fell to $1.144, a new 2.5-year low, and stayed around its epidemic quiet.

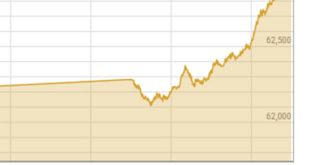

Meanwhile, the US dollar index, which compares the value of the US dollar to a basket of six other currencies, with the euro bearing the most weight, surged to a peak of 110.25, marking a new two-decade high.

Citing an oil leak in a turbine, Russia canceled a deadline for flows through the Nord Stream pipeline to restart on Saturday. The announcement of a price ceiling on Russian oil by the finance ministers of the Group of Seven coincided with it.

Concerns about growing energy prices have also hurt the pound. Liz Truss, the foreign minister of the United Kingdom, said over the weekend that if elected as the country’s next prime minister, she would take prompt action to address growing energy costs and expand energy supply.

“The forecast for natural gas in Europe is untrustworthy, which is terrible news for the euro. According to Osamu Takashima, head FX strategist at Citigroup Global Markets, Putin is a significant factor.

At 140.38 per dollar, the yen was weakening and getting close to a 24-year low. The volatile Australian dollar fell 0.41 percent and was trading close to $0.678, a seven-week low.

According to Vishnu Varathan, head of strategy and economics at Mizuho Bank in Singapore, “the first-order effect seems to be that the heightened geopolitical risk and consequent adverse global demand shocks will probably be the dominant effects.”

Unfavorable demand shocks in a hostile geopolitical climate will likely reflect and incite safe demand for the US dollar. The most vulnerable and damaged will be the European currencies.

This week might see disproportionate rate increases. Markets have priced around 80% of a potential increase of 75 basis points (bp) in Europe and approximately 70% of a possible 50 bp rise in Australia.

A more interventionist ECB (European Central Bank) would have been expected to boost the euro. However, Varathan warned that what you would experience is a problem and a trade-off in policy.

Pricing for a 75 basis point increase this month has been considerably reduced in the US after mixed employment data on Friday that included some indications of a tightening labor market.

Roughly 58 percent of Fed funds futures point to a 75 basis point rise.

In Asia, concerns over the country’s COVID-19 lockdown measures have caused the offshore yuan to drop to a new two-year low of 6.954 per dollar.

Shenzhen, China’s southern tech powerhouse, declared on Monday that it will implement a tiered anti-virus limitation system. At the same time, Chengdu announced an extension of lockdown limits as the nation deals with new outbreaks.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.