Investors were anticipating probable actions by Opec+ producers to reduce production and boost prices at a meeting later that day, which may lead to oil prices jumping above $1 per barrel on Monday.

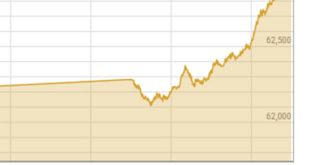

By 0345 GMT, after a 0.7 percent increase on Friday, Brent oil futures had climbed $1.88, or 2%, to $94.90 a barrel. The price of U.S. West Texas Intermediate crude oil rose 0.3 percent from the previous day to $88.60 per barrel, an increase of $1.73, or 2 percent.

The U.S. market will be closed on Monday during a public holiday.

While supplies are still tight, the Organization of the Petroleum Exporting Countries (Opec) and its allies, a group called Opec+, may vote to maintain or even reduce production at their meeting later on Monday to boost prices.

According to CMC Markets analyst Tina Teng, Opec+ will likely maintain oil prices due to restricted production in response to demand interruptions caused by the ongoing lockdowns in some sections of China.

During their meeting on Monday, the members of Opec+ are expected to maintain their current output levels, according to the Wall Street Journal, which cited anonymous sources familiar with the situation, as Russia, the world’s second-largest oil producer and an essential member of the group, does not currently favor a production decrease.

“Although we anticipate no change in production, the group’s tone could be more bullish as it seeks to reverse the recent decline in prices,” ANZ analysts said.

Teng of CMC said there are still adverse risks, even with the prospect of production reduction. He included concerns about a recession and possible exports from Iran as examples.

Following a surge to multi-year highs in March, oil prices have declined over the last three months on fears that interest rate rises and COVID-19 restrictions in some regions of China, the leading importer of crude oil, will dampen demand for the commodity and slow down global economic development.

More than 65 million people are now affected by partial or complete lockdowns in 33 cities in China as the world’s second-largest economy continues its strict zero-COVID policy, according to a local media estimate.

Although an agreement might enable Tehran to enhance global supply and boost exports, negotiations to renew the 2015 nuclear agreement between the West and Iran have drawn on. According to a Western official, on Friday, the White House denied that the agreement was tied to the U.N. nuclear watchdog’s decision to close its investigations, which Iran had reopened the day before.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.