Tuesday saw a little decline in oil prices, reversing gains from the previous session, as an agreement by Opec+ to reduce production by 100,000 barrels per day in October was seen as mostly a symbolic action to support prices after the recent decline in the market.

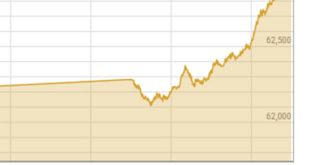

By 0354 GMT, Brent oil futures had dropped 81 cents, or 0.9%, to $94.93 per barrel.

US West Texas Intermediate (WTI) oil futures increased by 1.70 points, or 2 percent, from Friday’s closing to $88.57 a barrel on Monday. On Monday, the United States Labor Day holiday, there was no resolution.

Opec+, the Organization of Petroleum Exporting Countries and its allies headed by Russia, agreed to undo a 100,000 bpd increase for September after Saudi Arabia, the world’s largest producer, and other members expressed worry over the decline in prices since June despite a shortage of production.

Considering that Opec+ had been producing below production objectives, analysts said the decrease was mostly symbolic and had little effect on real supply. They had not anticipated the accord, especially after Saudi Arabia had said it intended to support prices.

In a note, Warren Patterson, head of commodities strategy at ING, said, “While the headline number is for a 100 mbbls/d cut, in reality, the actual cut will be much smaller… Most producers have not been able to hit their targets and are producing quite some distance below where they should be.”

However, as noted by Noah Barrett, research analyst for energy and utilities at Janus Henderson Investors, “it indicates that Opec+ is watching demand very closely and is trying to manage supply to keep a floor on oil prices.” The decision was significant in terms of signaling.

According to Tina Teng, an analyst at CMC Markets, other factors influencing the market included an agreement to impose price ceilings on Russian oil shipments and a lower forecast for oil consumption owing to ongoing lockdowns in certain sections of China.

Russia’s energy minister, Nikolai Shulginov, told reporters on Tuesday at the Eastern Economic Forum in Vladivostok that his nation would send more oil to Asia due to price limitations.

The head of EU foreign policy expressed pessimism about reviving the Iran nuclear deal, which would postpone the return of around a million barrels per day of Iranian oil to the market and drive up prices.

Tuesday saw a little decline in oil prices, reversing gains from the previous session, as an agreement by Opec+ to reduce production by 100,000 barrels per day in October was seen as mostly a symbolic action to support prices after the recent decline in the market.

By 0354 GMT, Brent oil futures had dropped 81 cents, or 0.9%, to $94.93 per barrel.

US West Texas Intermediate (WTI) oil futures increased by 1.70 points, or 2 percent, from Friday’s closing to $88.57 a barrel on Monday. On Monday, the United States Labor Day holiday, there was no resolution.

Opec+, the Organization of Petroleum Exporting Countries and its allies headed by Russia, agreed to undo a 100,000 bpd increase for September after Saudi Arabia, the world’s largest producer, and other members expressed worry over the decline in prices since June despite a shortage of production.

Considering that Opec+ had been producing below production objectives, analysts said the decrease was mostly symbolic and had little effect on accurate supply. They had not anticipated the accord, especially after Saudi Arabia had said it intended to support prices.

In a note, Warren Patterson, head of commodities strategy at ING, said, “While the headline number is for a 100 mbbls/d cut, in reality, the actual cut will be much smaller… Most producers have not been able to hit their targets and are producing quite some distance below where they should be.”

However, as noted by Noah Barrett, research analyst for energy and utilities at Janus Henderson Investors, “It indicates that Opec+ is watching demand very closely and is trying to manage supply to keep a floor on oil prices.” The decision was significant regarding signaling.

According to Tina Teng, an analyst at CMC Markets, other factors influencing the market included an agreement to impose price ceilings on Russian oil shipments and a lower forecast for oil consumption owing to ongoing lockdowns in certain sections of China.

Russia’s energy minister, Nikolai Shulginov, told reporters Tuesday at the Eastern Economic Forum in Vladivostok that his nation would send more oil to Asia due to price limitations.

The head of EU foreign policy expressed pessimism about reviving the Iran nuclear deal, which would postpone the return of around a million barrels per day of Iranian oil to the market and drive up prices.

Tuesday saw a little decline in oil prices, reversing gains from the previous session, as an agreement by Opec+ to reduce production by 100,000 barrels per day in October was seen as mostly a symbolic action to support prices after the recent decline in the market.

By 0354 GMT, Brent oil futures had dropped 81 cents, or 0.9%, to $94.93 per barrel.

US West Texas Intermediate (WTI) oil futures increased by 1.70 points, or 2 percent, from Friday’s closing to $88.57 a barrel on Monday. There was no resolution on Monday, the United States Labor Day holiday.

Opec+, the Organization of Petroleum Exporting Countries, and its allies headed by Russia agreed to undo a 100,000 bpd increase for September after Saudi Arabia, the world’s largest producer, and other members expressed worry over the price decline since June despite a shortage of production.

Considering that Opec+ had been producing below production objectives, analysts said the decrease was mostly symbolic and had little effect on accurate supply. They had not anticipated the accord, especially after Saudi Arabia had said it intended to support prices.

In a note, Warren Patterson, head of commodities strategy at ING, said, “While the headline number is for a 100 mbbls/d cut, in reality, the actual cut will be much smaller… Most producers have not been able to hit their targets and are producing quite some distance below where they should be.”

However, as noted by Noah Barrett, research analyst for energy and utilities at Janus Henderson Investors, “It indicates that Opec+ is watching demand very closely and is trying to manage supply to keep a floor on oil prices.” The decision was significant regarding signaling.

According to Tina Teng, an analyst at CMC Markets, other factors influencing the market included an agreement to impose price ceilings on Russian oil shipments and a lower forecast for oil consumption owing to ongoing lockdowns in certain sections of China.

Russia’s energy minister, Nikolai Shulginov, told reporters Tuesday at the Eastern Economic Forum in Vladivostok that his nation would send more oil to Asia due to price limitations.

The head of EU foreign policy expressed pessimism about reviving the Iran nuclear deal, which would postpone the return of around a million barrels per day of Iranian oil to the market and drive up prices.

Tuesday saw a little decline in oil prices, reversing gains from the previous session, as an agreement by Opec+ to reduce production by 100,000 barrels per day in October was seen as primarily a symbolic action to support prices after the recent decline in the market.

By 0354 GMT, Brent oil futures had dropped 81 cents, or 0.9%, to $94.93 per barrel.

US West Texas Intermediate (WTI) oil futures increased by 1.70 points, or 2 percent, from Friday’s closing to $88.57 a barrel on Monday. There was no resolution on Monday, the United States Labor Day holiday.

Opec+, the Organization of Petroleum Exporting Countries, and its allies headed by Russia agreed to undo a 100,000 bpd increase for September after Saudi Arabia, the world’s largest producer, and other members expressed worry over the price decline since June despite a shortage of production.

Considering that Opec+ had been producing below production objectives, analysts said the decrease was mostly symbolic and had little effect on accurate supply. They had not anticipated the accord, especially after Saudi Arabia had said it intended to support prices.

In a note, Warren Patterson, head of commodities strategy at ING, said, “While the headline number is for a 100 mbbls/d cut, in reality, the actual cut will be much smaller… Most producers have not been able to hit their targets and are producing quite some distance below where they should be.”

However, as noted by Noah Barrett, research analyst for energy and utilities at Janus Henderson Investors, “It indicates that Opec+ is watching demand very closely and is trying to manage supply to keep a floor on oil prices,” the decision was significant regarding signaling.

According to Tina Teng, an analyst at CMC Markets, other factors influencing the market included an agreement to impose price ceilings on Russian oil shipments and a lower forecast for oil consumption owing to ongoing lockdowns in certain sections of China.

Russia’s energy minister, Nikolai Shulginov, told reporters Tuesday at the Eastern Economic Forum in Vladivostok that his nation would send more oil to Asia due to price limitations.

The head of EU foreign policy expressed pessimism about reviving the Iran nuclear deal, which would postpone the return of around a million barrels per day of Iranian oil to the market and drive up prices.

Tuesday saw a little decline in oil prices, reversing gains from the previous session, as an agreement by Opec+ to reduce production by 100,000 barrels per day in October was seen as primarily a symbolic action to support prices after the recent decline in the market.

By 0354 GMT, Brent oil futures had dropped 81 cents, or 0.9%, to $94.93 per barrel.

US West Texas Intermediate (WTI) oil futures increased by 1.70 points, or 2 percent, from Friday’s closing to $88.57 a barrel on Monday. There was no resolution on Monday, the United States Labor Day holiday.

Opec+, the Organization of Petroleum Exporting Countries and its allies headed by Russia agreed to undo a 100,000 bpd increase for September after Saudi Arabia, the world’s largest producer, and other members expressed worry over the price decline since June despite a shortage of production.

Considering that Opec+ had been producing below production objectives, analysts said the decrease was mostly symbolic and had little effect on accurate supply. They had not anticipated the accord, especially after Saudi Arabia had said it intended to support prices.

In a note, Warren Patterson, head of commodities strategy at ING, said, “While the headline number is for a 100 mbbls/d cut, in reality, the actual cut will be much smaller… Most producers have not been able to hit their targets and are producing quite some distance below where they should be.”

However, as noted by Noah Barrett, research analyst for energy and utilities at Janus Henderson Investors, “It indicates that Opec+ is watching demand very closely and is trying to manage supply to keep a floor on oil prices.” The decision was significant regarding signaling.

According to Tina Teng, an analyst at CMC Markets, other factors influencing the market included an agreement to impose price ceilings on Russian oil shipments and a lower forecast for oil consumption owing to ongoing lockdowns in certain sections of China.

Russia’s energy minister, Nikolai Shulginov, told reporters Tuesday at the Eastern Economic Forum in Vladivostok that his nation would send more oil to Asia due to price limitations.

The head of EU foreign policy expressed pessimism about reviving the Iran nuclear deal, which would postpone the return of around a million barrels per day of Iranian oil to the market and drive up prices.

Tuesday saw a little decline in oil prices, reversing gains from the previous session, as an agreement by Opec+ to reduce production by 100,000 barrels per day in October was seen as mostly a symbolic action to support prices after the recent decline in the market.

By 0354 GMT, Brent oil futures had dropped 81 cents, or 0.9%, to $94.93 per barrel.

US West Texas Intermediate (WTI) oil futures increased by 1.70 points, or 2 percent, from Friday’s closing to $88.57 a barrel on Monday. On Monday, the United States Labor Day holiday, there was no resolution.

Opec+, the Organization of Petroleum Exporting Countries and its allies headed by Russia, agreed to undo a 100,000 bpd increase for September after Saudi Arabia, the world’s largest producer, and other members expressed worry over the decline in prices since June despite a shortage of production.

Considering that Opec+ had been producing below production objectives, analysts said the decrease was mostly symbolic and had little effect on real supply. They had not anticipated the accord, especially after Saudi Arabia had said it intended to support prices.

In a note, Warren Patterson, head of commodities strategy at ING, said, “While the headline number is for a 100 mbbls/d cut, in reality, the actual cut will be much smaller… Most producers have not been able to hit their targets and are producing quite some distance below where they should be.”

However, as noted by Noah Barrett, research analyst for energy and utilities at Janus Henderson Investors, “it indicates that Opec+ is watching demand very closely and is trying to manage supply to keep a floor on oil prices.” The decision was significant in terms of signaling.

According to Tina Teng, an analyst at CMC Markets, other factors influencing the market included an agreement to impose price ceilings on Russian oil shipments and a lower forecast for oil consumption owing to ongoing lockdowns in certain sections of China.

Russia’s energy minister, Nikolai Shulginov, told reporters on Tuesday at the Eastern Economic Forum in Vladivostok that his nation would send more oil to Asia due to price limitations.

The head of EU foreign policy expressed pessimism about reviving the Iran nuclear deal, which would postpone the return of around a million barrels per day of Iranian oil to the market and drive up prices.

Tuesday saw a little decline in oil prices, reversing gains from the previous session, as an agreement by Opec+ to reduce production by 100,000 barrels per day in October was seen as mostly a symbolic action to support prices after the recent decline in the market.

By 0354 GMT, Brent oil futures had dropped 81 cents, or 0.9%, to $94.93 per barrel.

US West Texas Intermediate (WTI) oil futures increased by 1.70 points, or 2 percent, from Friday’s closing to $88.57 a barrel on Monday. On Monday, the United States Labor Day holiday, there was no resolution.

Opec+, the Organization of Petroleum Exporting Countries and its allies headed by Russia, agreed to undo a 100,000 bpd increase for September after Saudi Arabia, the world’s largest producer, and other members expressed worry over the decline in prices since June despite a shortage of production.

Considering that Opec+ had been producing below production objectives, analysts said the decrease was mostly symbolic and had little effect on real supply. They had not anticipated the accord, especially after Saudi Arabia had said it intended to support prices.

In a note, Warren Patterson, head of commodities strategy at ING, said, “While the headline number is for a 100 mbbls/d cut, in reality, the actual cut will be much smaller… Most producers have not been able to hit their targets and are producing quite some distance below where they should be.”

However, as noted by Noah Barrett, research analyst for energy and utilities at Janus Henderson Investors, “it indicates that Opec+ is watching demand very closely and is trying to manage supply to keep a floor on oil prices.” The decision was significant in terms of signaling.

According to Tina Teng, an analyst at CMC Markets, other factors influencing the market included an agreement to impose price ceilings on Russian oil shipments and a lower forecast for oil consumption owing to ongoing lockdowns in certain sections of China.

Russia’s energy minister, Nikolai Shulginov, told reporters on Tuesday at the Eastern Economic Forum in Vladivostok that his nation would send more oil to Asia due to price limitations.

The head of EU foreign policy expressed pessimism about reviving the Iran nuclear deal, which would postpone the return of around a million barrels per day of Iranian oil to the market and drive up prices.

Tuesday saw a little decline in oil prices, reversing gains from the previous session, as an agreement by Opec+ to reduce production by 100,000 barrels per day in October was seen as mostly a symbolic action to support prices after the recent decline in the market.

By 0354 GMT, Brent oil futures had dropped 81 cents, or 0.9%, to $94.93 per barrel.

US West Texas Intermediate (WTI) oil futures increased by 1.70 points, or 2 percent, from Friday’s closing to $88.57 a barrel on Monday. On Monday, the United States Labor Day holiday, there was no resolution.

Opec+, the Organization of Petroleum Exporting Countries and its allies headed by Russia, agreed to undo a 100,000 bpd increase for September after Saudi Arabia, the world’s largest producer, and other members expressed worry over the decline in prices since June despite a shortage of production.

Considering that Opec+ had been producing below production objectives, analysts said the decrease was mostly symbolic and had little effect on real supply. They had not anticipated the accord, especially after Saudi Arabia had said it intended to support prices.

In a note, Warren Patterson, head of commodities strategy at ING, said, “While the headline number is for a 100 mbbls/d cut, in reality, the actual cut will be much smaller… Most producers have not been able to hit their targets and are producing quite some distance below where they should be.”

However, as noted by Noah Barrett, research analyst for energy and utilities at Janus Henderson Investors, “it indicates that Opec+ is watching demand very closely and is trying to manage supply to keep a floor on oil prices.” The decision was significant in terms of signaling.

According to Tina Teng, an analyst at CMC Markets, other factors influencing the market included an agreement to impose price ceilings on Russian oil shipments and a lower forecast for oil consumption owing to ongoing lockdowns in certain sections of China.

Russia’s energy minister, Nikolai Shulginov, told reporters on Tuesday at the Eastern Economic Forum in Vladivostok that his nation would send more oil to Asia due to price limitations.

The head of EU foreign policy expressed pessimism about reviving the Iran nuclear deal, which would postpone the return of around a million barrels per day of Iranian oil to the market and drive up prices.

Tuesday saw a little decline in oil prices, reversing gains from the previous session, as an agreement by Opec+ to reduce production by 100,000 barrels per day in October was seen as mostly a symbolic action to support prices after the recent decline in the market.

By 0354 GMT, Brent oil futures had dropped 81 cents, or 0.9%, to $94.93 per barrel.

US West Texas Intermediate (WTI) oil futures increased by 1.70 points, or 2 percent, from Friday’s closing to $88.57 a barrel on Monday. On Monday, the United States Labor Day holiday, there was no resolution.

Opec+, the Organization of Petroleum Exporting Countries and its allies headed by Russia, agreed to undo a 100,000 bpd increase for September after Saudi Arabia, the world’s largest producer, and other members expressed worry over the decline in prices since June despite a shortage of production.

Considering that Opec+ had been producing below production objectives, analysts said the decrease was mostly symbolic and had little effect on real supply. They had not anticipated the accord, especially after Saudi Arabia had said it intended to support prices.

In a note, Warren Patterson, head of commodities strategy at ING, said, “While the headline number is for a 100 mbbls/d cut, in reality, the actual cut will be much smaller… Most producers have not been able to hit their targets and are producing quite some distance below where they should be.”

However, as noted by Noah Barrett, research analyst for energy and utilities at Janus Henderson Investors, “it indicates that Opec+ is watching demand very closely and is trying to manage supply to keep a floor on oil prices,” the decision was significant in terms of signaling.

According to Tina Teng, an analyst at CMC Markets, other factors influencing the market included an agreement to impose price ceilings on Russian oil shipments and a lower forecast for oil consumption owing to ongoing lockdowns in certain sections of China.

Russia’s energy minister, Nikolai Shulginov, told reporters on Tuesday at the Eastern Economic Forum in Vladivostok that his nation would send more oil to Asia due to price limitations.

The head of EU foreign policy expressed pessimism about reviving the Iran nuclear deal, which would postpone the return of around a million barrels per day of Iranian oil to the market and drive up prices.

Tuesday saw a little decline in oil prices, reversing gains from the previous session, as an agreement by Opec+ to reduce production by 100,000 barrels per day in October was seen as mostly a symbolic action to support prices after the recent decline in the market.

By 0354 GMT, Brent oil futures had dropped 81 cents, or 0.9%, to $94.93 per barrel.

US West Texas Intermediate (WTI) oil futures increased by 1.70 points, or 2 percent, from Friday’s closing to $88.57 a barrel on Monday. On Monday, the United States Labor Day holiday, there was no resolution.

Opec+, the Organization of Petroleum Exporting Countries and its allies headed by Russia, agreed to undo a 100,000 bpd increase for September after Saudi Arabia, the world’s largest producer, and other members expressed worry over the decline in prices since June despite a shortage of production.

Considering that Opec+ had been producing below production objectives, analysts said the decrease was mostly symbolic and had little effect on real supply. They had not anticipated the accord, especially after Saudi Arabia had said it intended to support prices.

In a note, Warren Patterson, head of commodities strategy at ING, said, “While the headline number is for a 100 mbbls/d cut, in reality, the actual cut will be much smaller… Most producers have not been able to hit their targets and are producing quite some distance below where they should be.”

However, as noted by Noah Barrett, research analyst for energy and utilities at Janus Henderson Investors, “it indicates that Opec+ is watching demand very closely and is trying to manage supply to keep a floor on oil prices,” the decision was significant in terms of signaling.

According to Tina Teng, an analyst at CMC Markets, other factors influencing the market included an agreement to impose price ceilings on Russian oil shipments and a lower forecast for oil consumption owing to ongoing lockdowns in certain sections of China.

Russia’s energy minister, Nikolai Shulginov, told reporters on Tuesday at the Eastern Economic Forum in Vladivostok that his nation would send more oil to Asia due to price limitations.

The head of EU foreign policy expressed pessimism about reviving the Iran nuclear deal, which would postpone the return of around a million barrels per day of Iranian oil to the market and drive up prices.

Tuesday saw a little decline in oil prices, reversing gains from the previous session, as an agreement by Opec+ to reduce production by 100,000 barrels per day in October was seen as mostly a symbolic action to support prices after the recent decline in the market.

By 0354 GMT, Brent oil futures had dropped 81 cents, or 0.9%, to $94.93 per barrel.

US West Texas Intermediate (WTI) oil futures increased by 1.70 points, or 2 percent, from Friday’s closing to $88.57 a barrel on Monday. On Monday, the United States Labor Day holiday, there was no resolution.

Opec+, the Organization of Petroleum Exporting Countries and its allies headed by Russia, agreed to undo a 100,000 bpd increase for September after Saudi Arabia, the world’s largest producer, and other members expressed worry over the decline in prices since June despite a shortage of production.

Considering that Opec+ had been producing below production objectives, analysts said the decrease was mostly symbolic and had little effect on real supply. They had not anticipated the accord, especially after Saudi Arabia had said it intended to support prices.

In a note, Warren Patterson, head of commodities strategy at ING, said, “While the headline number is for a 100 mbbls/d cut, in reality, the actual cut will be much smaller… Most producers have not been able to hit their targets and are producing quite some distance below where they should be.”

However, as noted by Noah Barrett, research analyst for energy and utilities at Janus Henderson Investors, “it indicates that Opec+ is watching demand very closely and is trying to manage supply to keep a floor on oil prices,” the decision was significant in terms of signaling.

According to Tina Teng, an analyst at CMC Markets, other factors influencing the market included an agreement to impose price ceilings on Russian oil shipments and a lower forecast for oil consumption owing to ongoing lockdowns in certain sections of China.

Russia’s energy minister, Nikolai Shulginov, told reporters on Tuesday at the Eastern Economic Forum in Vladivostok that his nation would send more oil to Asia due to price limitations.

The head of EU foreign policy expressed pessimism about reviving the Iran nuclear deal, which would postpone the return of around a million barrels per day of Iranian oil to the market and drive up prices.

Tuesday saw a little decline in oil prices, reversing gains from the previous session, as an agreement by Opec+ to reduce production by 100,000 barrels per day in October was seen as mostly a symbolic action to support prices after the recent decline in the market.

By 0354 GMT, Brent oil futures had dropped 81 cents, or 0.9%, to $94.93 per barrel.

US West Texas Intermediate (WTI) oil futures increased by 1.70 points, or 2 percent, from Friday’s closing to $88.57 a barrel on Monday. On Monday, the United States Labor Day holiday, there was no resolution.

Opec+, the Organization of Petroleum Exporting Countries and its allies headed by Russia, agreed to undo a 100,000 bpd increase for September after Saudi Arabia, the world’s largest producer, and other members expressed worry over the decline in prices since June despite a shortage of production.

Considering that Opec+ had been producing below production objectives, analysts said the decrease was mostly symbolic and had little effect on real supply. They had not anticipated the accord, especially after Saudi Arabia had said it intended to support prices.

In a note, Warren Patterson, head of commodities strategy at ING, said, “While the headline number is for a 100 mbbls/d cut, in reality, the actual cut will be much smaller… Most producers have not been able to hit their targets and are producing quite some distance below where they should be.”

However, as noted by Noah Barrett, research analyst for energy and utilities at Janus Henderson Investors, “it indicates that Opec+ is watching demand very closely and is trying to manage supply to keep a floor on oil prices.” The decision was significant in terms of signaling.

According to Tina Teng, an analyst at CMC Markets, other factors influencing the market included an agreement to impose price ceilings on Russian oil shipments and a lower forecast for oil consumption owing to ongoing lockdowns in certain sections of China.

Russia’s energy minister, Nikolai Shulginov, told reporters on Tuesday at the Eastern Economic Forum in Vladivostok that his nation would send more oil to Asia due to price limitations.

The head of EU foreign policy expressed pessimism about reviving the Iran nuclear deal, which would postpone the return of around a million barrels per day of Iranian oil to the market and drive up prices.

Tuesday saw a little decline in oil prices, reversing gains from the previous session, as an agreement by Opec+ to reduce production by 100,000 barrels per day in October was seen as mostly a symbolic action to support prices after the recent decline in the market.

By 0354 GMT, Brent oil futures had dropped 81 cents, or 0.9%, to $94.93 per barrel.

US West Texas Intermediate (WTI) oil futures increased by 1.70 points, or 2 percent, from Friday’s closing to $88.57 a barrel on Monday. On Monday, the United States Labor Day holiday, there was no resolution.

Opec+, the Organization of Petroleum Exporting Countries and its allies headed by Russia, agreed to undo a 100,000 bpd increase for September after Saudi Arabia, the world’s largest producer, and other members expressed worry over the decline in prices since June despite a shortage of production.

Considering that Opec+ had been producing below production objectives, analysts said the decrease was mostly symbolic and had little effect on real supply. They had not anticipated the accord, especially after Saudi Arabia had said it intended to support prices.

In a note, Warren Patterson, head of commodities strategy at ING, said, “While the headline number is for a 100 mbbls/d cut, in reality, the actual cut will be much smaller… Most producers have not been able to hit their targets and are producing quite some distance below where they should be.”

However, as noted by Noah Barrett, research analyst for energy and utilities at Janus Henderson Investors, “it indicates that Opec+ is watching demand very closely and is trying to manage supply to keep a floor on oil prices.” The decision was significant in terms of signaling.

According to Tina Teng, an analyst at CMC Markets, other factors influencing the market included an agreement to impose price ceilings on Russian oil shipments and a lower forecast for oil consumption owing to ongoing lockdowns in certain sections of China.

Russia’s energy minister, Nikolai Shulginov, told reporters on Tuesday at the Eastern Economic Forum in Vladivostok that his nation would send more oil to Asia due to price limitations.

The head of EU foreign policy expressed pessimism about reviving the Iran nuclear deal, which would postpone the return of around a million barrels per day of Iranian oil to the market and drive up prices.

Tuesday saw a little decline in oil prices, reversing gains from the previous session, as an agreement by Opec+ to reduce production by 100,000 barrels per day in October was seen as mostly a symbolic action to support prices after the recent decline in the market.

By 0354 GMT, Brent oil futures had dropped 81 cents, or 0.9%, to $94.93 per barrel.

US West Texas Intermediate (WTI) oil futures increased by 1.70 points, or 2 percent, from Friday’s closing to $88.57 a barrel on Monday. On Monday, the United States Labor Day holiday, there was no resolution.

Opec+, the Organization of Petroleum Exporting Countries and its allies headed by Russia, agreed to undo a 100,000 bpd increase for September after Saudi Arabia, the world’s largest producer, and other members expressed worry over the decline in prices since June despite a shortage of production.

Considering that Opec+ had been producing below production objectives, analysts said the decrease was mostly symbolic and had little effect on real supply. They had not anticipated the accord, especially after Saudi Arabia had said it intended to support prices.

In a note, Warren Patterson, head of commodities strategy at ING, said, “While the headline number is for a 100 mbbls/d cut, in reality, the actual cut will be much smaller… Most producers have not been able to hit their targets and are producing quite some distance below where they should be.”

However, as noted by Noah Barrett, research analyst for energy and utilities at Janus Henderson Investors, “it indicates that Opec+ is watching demand very closely and is trying to manage supply to keep a floor on oil prices.” The decision was significant in terms of signaling.

According to Tina Teng, an analyst at CMC Markets, other factors influencing the market included an agreement to impose price ceilings on Russian oil shipments and a lower forecast for oil consumption owing to ongoing lockdowns in certain sections of China.

Russia’s energy minister, Nikolai Shulginov, told reporters on Tuesday at the Eastern Economic Forum in Vladivostok that his nation would send more oil to Asia due to price limitations.

The head of EU foreign policy expressed pessimism about reviving the Iran nuclear deal, which would postpone the return of around a million barrels per day of Iranian oil to the market and drive up prices.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.