Oil prices increased on Friday as investors took into account Russia’s warning to stop exporting gas and oil to specific clients. However, demand for petroleum was expected to be affected by China’s COVID-19 limitations and the aggressive rate rises by central banks, resulting in a second consecutive weekly decrease in prices.

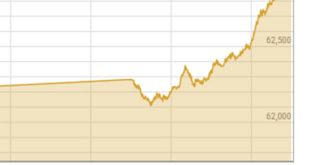

By 0330 GMT, Brent oil futures had increased by 27 cents, or 0.3%, to $89.42 per barrel. Crude futures for the US West Texas Intermediate (WTI) increased by 15 cents, or 0.2 percent, to $83.69.

According to CMC Markets analyst Tina Teng, “I think the selloff in oil prices may come to a pause for now due to a recovery in risk sentiment across the board.” She also noted that a decline in bond rates and a weaker dollar have provided support for the rise in risk assets.

Though economic worries may still be significant, Teng said, “Fundamentally, a sharp decline in the US SPR suggests that undersupply is still a predominant issue in the physical oil markets.”

Both oil benchmarks were expected to fall by 4 percent on a weekly basis, and the market once fell to its lowest position since January this week.

The fall is restrained by underlying supply constraints brought on by Russia’s threat to stop supplying oil to any nation that supports a price ceiling on its petroleum, as well as by a slight output reduction by Opec and its allies and a less optimistic view for the rise of US oil production.

Earlier than anticipated, the US Energy Information Administration predicted that US oil production would climb by 610,000 barrels per day to 11.79 million barrels per day in 2022. This prediction was made on Thursday.

The selloff that dropped the 50-day moving average below the 200-day moving average mid-week in a “death cross” may have been exaggerated, according to analysts, given the supply picture, because demand in China, the largest oil importer in the world, might rebound quickly.

Demand in China is harder to forecast. However, post-Covid reopening, demand has historically experienced a spike rather than a steady increase. Analysts at National Australia Bank said in a report that “the fundamentals appear skewed against the latest technical signals in that context.”

China is currently increasing its restrictions. The majority of Chengdu’s more than 21 million citizens were placed under further lockdown on Thursday, while millions more people around China were advised not to travel over the approaching holidays.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.