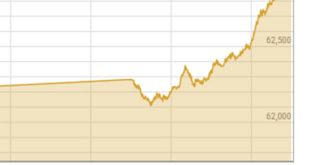

The rupee, which has been weakening against the US dollar for over a week, dropped by Rs3.05 in the early going on Friday in the interbank market.

Following a 1.35 percent depreciation from yesterday’s closing, the PKR was trading at Rs 228.5 per dollar at 10:56 am, according to data released by the Forex Association of Pakistan (FAP).

The director of Mettis Global, Saad bin Naseer, said that payments and a mismatch in supply and demand were driving down the value of the currency.

He continued by saying that quarter-end payments will continue to put strain on the system. This week, some payments for oil were made. In addition, the difference in [rates] between the open and interbank markets had grown considerably, which caused bankers to raise the dollar rates progressively.

He went on, “It’s the reason for panic because remittances are slow, exporters are on hold, and banks are quoting way higher bid prices to exporters.”

He said that the greenback was accessible and that there was no panic in the interbank market today.

In order to draw in dollar inflows, Naseer recommended that the State Bank of Pakistan (SBP) raise the rates on the Roshan Digital Account (RDA). He said, “The RDA rates have not changed compared to the US Treasury bonds, so the momentum [of dollar inflows] has slowed.”

Tresmark’s Head of Research, Komal Mansoor, said that pressure was mounting and that there was a growing gap between the interbank and open markets.

“There is a positive trend, and the pressure will grow due to rising import costs for food and other necessities,” she said.

According to a Tresmark survey, 35 percent of experts predicted that the USD/PKR would trade between 226 and 235 by the end of this month, according to Mansoor.

According to Zafar Paracha, General Secretary of the Exchange Companies Association of Pakistan (Ecap), exporters have been delaying payments due to the significant disparity in exchange rates between the markets.

For a few days, banks had been attempting to manage the rate. It is anticipated that exporters will begin to release their payments since they have begun to increase their rates.

Additionally, Paracha blamed smuggling for the rupee’s value decrease, claiming that the market had “never seen smuggling on this scale.” He added that the US was being smuggled into Afghanistan and Iran and urged the government to review its economic practices with those two nations.

According to him, friendly country inflows—which were anticipated after the IMF’s deposit—had not yet materialized, and political unpredictability was preventing foreign governments from contributing to flood relief operations.

The general secretary of Ecap issued a warning, stating that things may grow worse in the days ahead and urging all parties involved to get together to talk about ways to restore economic stability.

Between September 2 and 8, the PKR lost Rs6.82, while the dollar increased in value by Rs4 in only the previous two days.

The local currency lost 25.62 percent of its value in relation to the US dollar during the previous 52 weeks, according to financial data and analytics platform Metis Global.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.