Market Dynamics: KSE-100’s Volatile Trading Amid Economic Concerns

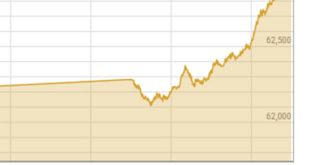

- Opening Trends: The KSE-100 index began positively but soon stagnated, reflecting investor caution amidst rising inflation and political instability.

- Profit-Taking: A last-hour sell-off for profit realization pushed the index into negative territory, highlighting the fragile market sentiment.

- Currency Depreciation: The Pakistani rupee’s continued depreciation against the dollar, losing 0.47% to stand at 219.41, exacerbated concerns, influencing market mood negatively.

- Taxation and IMF Meeting: New taxes, in anticipation of an IMF review, further dented share prices, contributing to the bearish trend.

- Closing Figures: The KSE-100 index closed at 43,032.57, down by 305.4 points, marking a 0.7% decrease from the previous week.

Trading Volume and Value

- Decreased Activity: Trading volumes fell by 18.9% to 208.1 million shares, with the total traded value also dropping by 11% to $35.5 million.

Top Movers and Sectors

- Active Stocks: WorldCall Telecom, Hascol Petroleum, Pakistan International Airlines, Nishat Chunian Power, and Telecard were among the most traded shares.

- Sectoral Impact: Power generation, fertilizers, exploration and production, banking, and technology sectors were the major contributors to the index’s decline.

Stock Performance

- Gainers: Sanofi-Aventis Pakistan, Reliance Cotton Spinning Mills, Premium Textile Mills, Lucky Cement, and Hafiz Ltd saw notable increases.

- Losers: Sapphire Textile Mills, along with Colgate-Palmolive Pakistan, Mari Petroleum, ICI Ltd, and Siemens Pakistan, experienced significant drops.

Foreign Investment

- Investor Sentiment: Foreign investors emerged as net buyers, injecting $0.5 million into the market, indicating some level of international confidence despite domestic challenges.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.