The fact that Pakistan’s stock and currency markets aren’t feeling particularly upbeat despite Qatar’s stated commitment to spend $3 billion in important commercial and investment areas of the country’s economy suggests that these markets require more than just verbal assurances to improve.

It hasn’t helped that the ambitions of the gas-rich Gulf state are unclear, as is the timeline for the planned investment. Furthermore, it’s unclear if the $2 billion that Doha has committed to deposit with the State Bank to support its declining foreign exchange reserves and fulfill an obligation under the terms of the Islamabad-IMF deal will overlap with the promised investment made through Qatar’s sovereign wealth fund, the Qatar Investment Authority.

The UAE had committed to investing $1 billion in various industries of Pakistan, and now Qatar has followed suit with a similar pledge.

The Public Accounts Committee met at the same time as Doha’s investment promise, and they learned that there has been no progress on the proposed 2019 Saudi plan to invest $8 billion in a new oil refinery in Gwadar. This has given the markets reason to be skeptical of the Gulf’s recent investment pledges. On Thursday, Riyadh also unveiled a $1 billion investment package for Pakistan, but the specifics remain hazy.

That said, in a challenging external environment, the State Bank’s depleting foreign exchange reserves will be considerably increased shortly upon the realization of the investment plans of Qatar, Saudi Arabia, and the Emirates in a wide range of industries, from the hospitality and aviation sector to seaport terminals, LNG-fired power plants, and solar power. However, it won’t address the economy’s underlying issues or its ongoing failure to generate enough revenue to cover its import expenses.

Pakistan is currently dealing with one of the worst economic crises in its history due to a balance-of-payments issue. To avoid a default, Islamabad has been obliged to resort to multilateral lenders and “friendly” nations like China, Saudi Arabia, the United Arab Emirates, and Qatar for dollars.

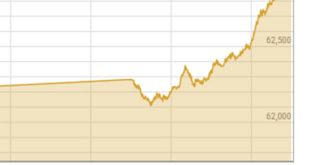

Pakistan is having difficulty managing a concerning current account deficit, one of the fastest-growing rates of inflation in the world, and a declining exchange rate. Its foreign currency reserves have fallen to less than $8 billion, or less than 1.5 months’ worth of imports.

The State Bank attempted to reassure investors earlier this week by stating that the nation’s needs for external finance had been more than satisfied for the current fiscal year and that reserves will probably double to $16 billion by the end of the fiscal year.

Even if it’s only a temporary alleviation, borrowed funds were used to make it happen. The difficult part is fixing the structural problems that have long beset the economy. Some solutions include increasing exports and domestic productivity, attracting private investment to cut debt, resolving balance-of-payment difficulties, and putting the economy on a more rapid and sustainable growth path.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.