A perfect storm is sweeping through the world economy. The super-cycle in commodities has driven up the cost of necessities to all-time highs. On the other hand, as interest rates rise in the US and EU markets, emerging countries are facing a capital flight. Depleting central bank reserves and growing import costs are putting pressure on emerging economies. Zambia, Sri Lanka, Suriname, and Lebanon are already past due.

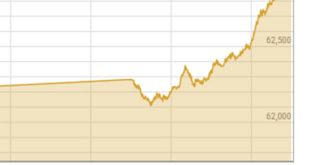

Pakistan has fared better since the government’s preemptive actions prevented the default danger. These consist of budgetary adjustments to reinstate the IMF programme and steps to limit imports. The policy actions have been well-received by the market, as seen by the dramatic drop in the yields on Pakistani sovereign international bonds, which peaked at 50% in July 2022 and are now only 22%. The rupee has surged by more than 10 percent in the last week, while the stock market has increased by 7 percent in August.

The significant external funding demands over the medium term, however, continue to cast a long shadow over the economy, even with the recent improvements in morale. Over the medium term, Pakistan’s needs for external funding are expected to remain high, at $35 billion to $40 billion yearly, according to the IMF staff study released in February 2022.

For local firms to thrive, the foreign exchange market must remain stable in order to manage inflation expectations, encourage new investment, and foster growth. The demand for dollars is still far larger than the supply on the market, thus the rupee will likely continue to face pressure due to the huge external finance demands, at least in the short term.

We are essentially priced out of the foreign bond markets due to the general poor mood on the capital markets throughout the world and the downgrading of the rating outlook by international rating agencies. As a result, the economy becomes overly reliant on bilateral loans from friendly nations and borrowing from multilateral organisations. We are not in a strong position to negotiate improved terms and conditions because of the significant financial requirements in emerging economies.

In order to ensure stability, it is therefore necessary to explore and manage alternative sources of dollar-funding in the medium term, in addition to making sure that the country’s current forex flows continue to trickle in without interruption and prevent any market see-sawing of the exchange rate, as was recently observed.

Read: The standard answer

It is appropriate to implement certain measures when things are going well, as they are in the currency market right now, to encourage exporters and remitters to bring in the foreign currency remittances that are currently stuck outside the nation, guarantee their prompt arrival, and maintain market stability.

The central bank needs to interact more effectively with money changers and banks, possibly even on a daily basis at the treasury level. Additionally, it is imperative that discipline be applied more strictly and forcefully.

On the other hand, the State Bank of Pakistan’s (SBP) Roshan Digital Account (RDA) project and the Pakistani government’s Naya Pakistan Certificates (NPC) represent the most significant alternative source of external finance over the past three years. Since September 2020, almost $4.8 billion in inflows have materialised under this scheme, of which $3.1 billion had been invested in NPC.

However, because of unfavourable conditions in the global market, inflows have dramatically slowed down in recent months. The benchmark six-month Libor is currently trading at about 3.6 percent, up from 0.15 percent during the same period last year. Despite the significant increase in worldwide interest rates, the profit rates given on NPCs have not altered, ranging from 5.5 percent to 7 percent for various tenors.

NPC instruments must have market-based profit rates that are correlated with Libor rates. The NPC profit rate of 8.5pc will be far less than the borrowing cost from international bond markets, which is currently at 22pc, even at a spread of 500 basis points above the Libor. Maintaining the appeal of NPC products is critical to attracting new investors and deterring current ones from leaving.

The huge and expanding onshore holding of foreign currency assets, primarily cash held by individuals for savings or payment requirements, is the second area that requires attention. The magnitude of the foreign currency deposits held by the banking industry is the first indicator of the assets’ significance, even though official estimates of their size are unavailable. These have decreased from $7.1 billion to roughly $5.8 billion this year. Prior to the freezing of foreign exchange accounts in 1998, the total amount of these deposits was as much as $11 billion.

The second piece of information is the amount of currency in circulation, which according to the most recent SBP data has climbed to Rs8 trillion ($35 billion). This amounts to about 30% of the entire money supply in the economy and 40% of bank deposits.

High levels of currency in circulation also have a strong inflationary effect. Prior market turbulence episodes resulted in money printing by the SBP because banks’ low deposit bases made it difficult for them to meet the government’s needs for deficit financing.

Many private individuals move their cash holdings into dollars during uncertain times and volatile exchange rates. The paucity of returns provided by commercial banks and the scarcity of other investment options are the main reasons why investors choose to keep foreign currency assets “under the mattresses,” or in cash or bank vaults. For obvious reasons, there is also reluctance to disclose these assets to tax authorities.

Consequently, the main goal should be to reduce the amount of currency in circulation. This can only be accomplished by lowering the government’s financing requirements, which can be achieved in two ways: either by reducing the amount of debt serviced by maintaining appropriate policy rate levels (since the demand for currency in circulation is not sensitive to changes in policy rates) or by preventing new debt through increased tax and non-tax revenues. We must constantly remember ourselves that in order to pay off our current debt, we must borrow.

The alternative is to make sure that the increased money supply is put to use meeting the economy’s basic needs, which at this point are dollar inflows. These should ideally come from exports or other sources of investment, such as bank deposits, to increase the nation’s foreign exchange pool and relieve pressure on the government’s reserves. Currently, investors that deposit foreign currencies will only receive between 0.2 and 0.75 percent; however, larger depositors may be able to negotiate a higher rate. Conversely, commercial banks in India provide foreign currency deposits with returns of at least 2.85 percent. In order to encourage banks to increase foreign currency deposits, the Indian central bank has lifted the Cash Reserve Requirement (CRR) and Statutory Liquidity Requirement (SLR) requirements.

The authors are the president and CEO of the Bank of Punjab, respectively, and a former governor of the State Bank of Pakistan.

This is the first of two articles; the second will be published in Dawn tomorrow.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.