On Wednesday, US economic statistics supported the belief that the Federal Reserve would continue its aggressive policy tightening, and the dollar rose to a 24-year high against the yen.

Despite actions taken by authorities to stop its drop, the Chinese yuan fell to a two-year low and was about to cross the psychologically significant 7 per dollar barrier. The peso fell to an all-time low.

The euro was trading well below parity, not far from its two-decade low on Tuesday, as ministers from the European Union were ready to meet on Friday to talk about the energy crisis that is crippling businesses and pinching consumers.

According to a survey released overnight, the US services sector surprisingly recovered last month, supporting the idea that the economy is not in a recession and allowing the Federal Reserve to proceed with an enormous 75 basis-point rate hike on September 21.

As of right now, markets are assigning a 75% chance to that scenario, with 25% odds of a half-point increase.

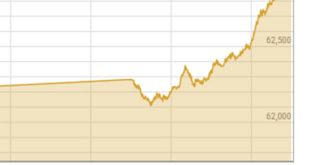

The dollar surged to 144.38 yen, its highest level since August 1998. Because of how easily changes in long-term US interest rates affect Japan’s yen, the yield on the 10-year Treasury note increased to 3.365 percent in Tokyo trade, a level not seen since June 16.

Chief Cabinet Secretary Hirokazu Matsuno, Japan’s top government spokesman, escalated the vocabulary to characterize the yen’s roughly 9-pc month-long slide, saying at a press conference that the administration would prefer to take required actions if “rapid, one-sided” changes in currency markets continue.

The Jiji news agency had earlier in the day cited Japanese Finance Minister Shunichi Suzuki in similar terms.

“The rate at which the dollar is strengthening versus the yen is out of control and could become unanchored,” said Davis Hall, head of Indosuez Wealth Management Asia’s capital markets division.

He said, “At this point, you’re encouraging everyone to give up by throwing in the towel.” “Without action from the Ministry of Finance (MOF), we could reach 148.”

However, a growing divergence in monetary policy is driving the yen’s slide against the dollar, and many experts see intervention as challenging. They claim that unilateral action would be much less successful.

According to Rikiya Takebe, senior analyst at Okasan Securities, “foreign central banks are prioritizing dealing with inflation and cannot afford to worry about exchange rate fluctuations.”

“The Bank of Japan’s attempts to intervene in the currency market or change its policies are probably going to be challenging, and stopping the yen’s decline won’t be simple.” According to currency experts surveyed by Reuters, the dollar will continue to be a powerful force over the rest of this year and into the next as US interest rates increase and the US economy continues to outperform its rivals.

The euro fell below 99 cents throughout the night, reaching as low as $0.9864. Although the European Central Bank is expected to raise interest rates by 75 basis points on Thursday, markets are more preoccupied with Russia’s decision to keep the crucial Nord Stream 1 gas pipeline closed indefinitely.

Amidst the energy crisis, the pound dropped 0.32 percent to $1.1480, nearing the two-and-a-half-year low of $1.1444 that was achieved on Monday. This is even though new Prime Minister Liz Truss has plans for a substantial assistance package.

The US dollar index, which compares the value of the dollar to six important competitors, reached a new 20-year high of 110.69.

Even after the central bank kept setting the currency’s official guidance stronger than market predictions, the onshore yuan continued to drop, reaching a low of 6.9808, the lowest level since August 2020. Disappointing Chinese trade statistics further eroded the sentiment.

The peso fell to a record low of 57.32 per US dollar.

At $0.5997, the New Zealand dollar has fallen to its lowest level since May 2020, while the Singapore dollar has fallen to its lowest level since June 2020, trading at 1.4107 against the US dollar.

The value of the cryptocurrency bitcoin fell to $18,540, its lowest level since June 19, continuing a 5 percent decline from Tuesday.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.