COVID-19 restrictions in China sparked concerns of a worldwide economic crisis and decreased gasoline consumption, the world’s largest petroleum importer and anticipation of more interest rate rises. On Wednesday, oil prices dropped more than $1 to their lowest point since before Russia invaded Ukraine.

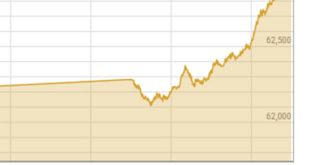

At 0420 GMT, Brent oil futures had down 1.5%, or $1.35, to $91.48 a barrel after falling 3.0% during the previous trading session. At $91.35, the contract reached its lowest session low since February 18.

Crude futures for US West Texas Intermediate dropped $1.55, or 1.8 percent, to $85.33. The benchmark dropped to $85.17, the lowest level since January 26.

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, known as OPEC+, resolved to reduce production by 100,000 barrels per day in October, which caused the price of oil to retreat from its sharp gains recorded on Monday.

Senior market analyst at OANDA, Edward Moya, said in a note that “fading the OPEC+ production cut bounce wasn’t that hard to do given a laundry list of global economic challenges.”

“Crude prices are in danger as global growth is not looking good, despite some better-than-expected US service data.”

According to Tina Teng, an analyst at CMC Markets, reasons driving down oil prices include a strengthening US currency, aggressive rate rises, a surge in bond rates, and a slowdown in China’s GDP.

Teng said, “To put it briefly, oil futures markets are pricing in stagflation in the global economy.”

Due to China’s strict zero-covid policy, the country’s second-largest oil user, Chengdu, with a population of 21.2 million, has been forced to live under lockdown, limiting travel and reducing demand for oil.

August saw a slowdown in the nation’s imports and exports, with growth far below expectations. The customs statistics for August indicated a 9.4% decrease in crude oil imports compared to the same month last year. The decline was attributed to plant outages at state-run refineries and reduced operations at independent facilities with poor margins.

Investors are keeping an eye out for any increases in interest rates to tame inflation. When it meets on Thursday, the European Central Bank is most likely to raise interest rates significantly. On September 21, the US Federal Reserve will meet after the ECB meeting.

Following the release of US economic data that supported the expectation that the Federal Reserve would continue its aggressive policy tightening, the dollar on Wednesday touched a 24-year high against the yen and new highs against the Australian and New Zealand currencies.

However, the prospects of reduced oil stocks in the US helped to bolster prices somewhat.

According to a preliminary Reuters poll released on Tuesday, US crude stocks are predicted to have decreased for a fourth straight week, falling by an estimated 733,000 barrels in the week leading up to September 2.

According to Department of Energy statistics, crude stockpiles in the US Strategic Petroleum Reserve (SPR) decreased by 7.5 million barrels in the week ending September 2 to 442.5 million barrels, the lowest level since November 1984.

Due to the national holiday on Monday, the weekly US inventory reports from the Energy Information Administration and the American Petroleum Institute will be issued on Thursday and Wednesday, respectively, one day later than normal.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.