ISLAMABAD: The Ministry of Finance and the Federal Board of Revenue (FBR) expressed their ignorance about foreign currency declarations made by international passengers upon arrival in Pakistan on the orders of the Civil Aviation Authority (CAA), which further put pressure on local currency amid the depreciating value of the rupee.

The Senate Standing Committee on Finance was informed during a meeting on Wednesday that the Financial Action Task Force (FATF) and Asia Pacific Group (APG) delegation would be visiting the site on August 16 and that the orders for the requirement of the Financial Monitoring Unit (FMU) had been issued by the CAA on August 16. On September 2, the delegation’s tour came to an end.

The CAA directive mandated that all international aircraft arriving into the country make sure that every passenger filled out a pro forma disclosing whatever they owned in foreign cash, and that the airlines sent all of these declarations to the CAA. Dr. Inayat Hussain, the deputy governor of the State Bank of Pakistan, said in her testimony before the committee that this was one of the factors for the current pressure on the currency.

The foreign exchange firms had complained about the CAA rule, which made incoming travelers reluctant to carry foreign cash, according to the deputy governor of SBP.

Due to the absence of the finance ministry and FBR, CAA flies a solo flight.

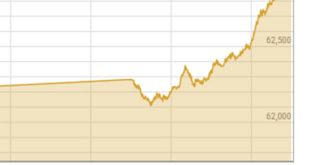

In a related development, Finance Minister Miftah Ismail stated at a press conference that while he had anticipated an increase in the value of the rupee relative to the dollar following IMF inflows, the subsequent floods destroyed a significant portion of the cotton crop, necessitating the import of $1–2 billion worth of cotton to meet demands for textile exports. In addition, the market was responding to future estimates that a 20 percent decline in tomatoes and onions would need some imports.

Asim Ahmad, the chairman of the FBR, said that his organization was not involved in the decision to require the disclosure of foreign cash since it lacked the authority under the Customs Act to put limits on the inbound flow of foreign currency. Dr. Aisha Pasha, the Minister of State for Finance, said that she was also not aware of the CAA ruling.

“Our understanding was that the CAA issued the circular with consent from Pakistan Customs,” the SBP deputy governor said at this point.

An additional secretary of the finance ministry called the director general of the national FATF cell upon request from the committee, and returned to the meeting to verify that the necessary arrangements had been made to comply with the standards of the Paris-based watchdog.

The SBP deputy governor also informed the committee that since the central bank approved the export of dollars on August 15, foreign exchange firms have exported around $7 million.

He added that since there was less demand for US currency in the local market after the dollar’s value fell to Rs214 from around Rs240, the exchange businesses had asked for permission to export dollars or SBP should buy US money.

He said that once the rupee came under pressure once again on Tuesday, the SBP once more connected the export of dollars to prior clearance. He said that the depreciation of the US dollar has led to an increase in the availability of cash dollars with exchange businesses.

The meeting’s chairman, Senator Saleem Mandviwalla, said that arriving travelers should not declare foreign cash, but he did not pursue the SBP officials’ request. But he said that, given the scarcity of dollars in Pakistan, the central bank ought not to have permitted their export. Senator Talha Mehmood, the federal minister for state and frontier regions, backed the idea that the move to export US dollars increased pressure on the rupee’s value.

The SBP deputy governor stated that the exchange companies bought $4.4 billion from local clients and sold $2.2 billion in interbank transactions in the previous fiscal year. The exchange companies exported $3.1 billion worth of foreign currencies during the previous fiscal year, and the US dollars were then sold to the commercial banks through their Nostro Accounts.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.