Due to worries over supply, oil prices increased somewhat on Wednesday. However, investor fears that this could trigger a recession and reduce fuel demand prevented advances due to forecasts of yet another aggressive interest rate hike by the US government.

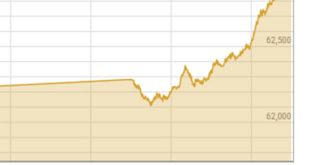

After dropping $1.38 the day before, Brent crude futures gained 11 cents, or 0.1%, to $90.73 a barrel by 04:15 GMT.

US West Texas Intermediate oil was up five cents, or 0.1 percent, to $83.99 a barrel. On Tuesday, the more active November delivery contract lost $1.42 while the October delivery contract expired down $1.28.

According to Tina Teng, an analyst at CMC Markets, “the undersupply issue that is caused by sanctions on Russia is always the bullish factor.” “Iran’s nuclear agreement encountered difficulties; additional supply is not anticipated anytime soon.”

The likelihood of Iranian barrels being put back on the international market has decreased after the United States stated that it did not anticipate any progress this week at the UN General Assembly towards the revival of the 2015 Iran nuclear deal.

The Organisation of the Petroleum Exporting Countries (Opec+) producer group, which includes Russia, is currently producing 3.58 million fewer barrels per day than it had planned, or around 3.5 percent of the world market. This is a historic shortfall. The shortage draws attention to the market’s underlying supply scarcity.

However, Teng said that oil prices continued to be pressured by a further increase in US bond yields, which strengthened the US currency ahead of the US Federal Reserve’s rate announcement.

In an effort to control inflation, the Fed is predicted by most to raise interest rates by 75 basis points for the third consecutive meeting later on Wednesday.

This week also sees meetings of other central banks, such as the Bank of England.

According to Vandana Hari, founder of Vanda Insights in Singapore, “crude, by default, is under the influence of the gloomy mood in the broader financial markets in the absence of any major fresh developments on the fundamentals front.”

As investors prepared for the Fed’s announcement later in the day, stocks in Asia plummeted and bond yields increased on Wednesday.

Additionally, the dollar’s value relative to a basket of currencies was close to a two-decade high on Wednesday, increasing the cost of oil for holders of other currencies.

Meanwhile, according to market sources citing American Petroleum Institute data on Tuesday, US crude and fuel stocks increased by almost a million barrels for the week that concluded on September 16.

An extended Reuters poll from last week indicated that US crude oil stockpiles increased by about 2.2 million barrels in the week ending September 16.

The president of Saudi Arabia’s state oil company, Aramco, issued a warning on Tuesday, stating that when the world economy improves, the spare oil production capacity might be rapidly depleted.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.