The rupee dropped 84 paise in morning interbank trading on Wednesday, approaching an all-time low versus the US dollar.

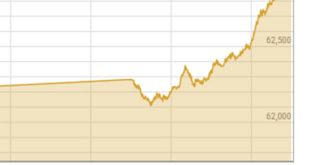

According to data released by the Forex Association of Pakistan (FAP), the local currency was trading at Rs239.75 per dollar at 12:13 p.m., down 0.35 percent from yesterday’s finish of Rs238.91. On July 28, the rupee fell to a record low of 239.94 per dollar.

The administration is “paralyzed by inaction even though we are now in an IMF (International Monetary Fund) program and can attract forex,” according to Tresmark’s Head of Research, Komal Mansoor.

“There are numerous advantages to intervening in a market as illiquid as Pakistan,” the speaker stated.

Mansoor pointed out that the Pakistani rupee was the worst-performing currency in the area, even though the strength of the dollar was a major worry for all economies.

In relation to a basket of currencies, the dollar was trading close to a two-decade high on Wednesday as US Treasury yields spiked higher in anticipation of another aggressive rate hike from the US Federal Reserve.

The US dollar index, which evaluates the US dollar relative to a basket of nations, increased by 0.1 percent to 110.27 on Friday, continuing its overnight rise of 0.6 percent. It was still very close to the 20-year high of 110.79 reached this month.

Expert economist Dr. Shahid Hasan Siddiqui stated that smuggling into Afghanistan was the reason for the rupee’s depreciation.

According to him, travelers from the bordering nation claimed to have $100,000 for transit trade when they crossed the border. On the other hand, they returned with $100,000 instead of carrying any foreign currency. He asserted that this was increasing the pressure on the currency.

He recommended that the number of dollars sold to individuals departing Pakistan be limited by the government.

Siddiqui questioned the role of the State Bank of Pakistan, arguing that the central bank ought to order the removal of the treasurer and president of any banks found to be engaged in speculating, as opposed to merely issuing fines.

The economist made additional recommendations, including that under-invoicing by importers and exporters should be prevented, exchange company licenses implicated in hawala/hundi should be withdrawn, and imports that aren’t necessary should be controlled.

Siddiqui stated that although Pakistan was not able to prohibit imports as per the terms of its WTO agreement, it ought to persuade the world community that it was unable to let importation of non-essential items because of a lack of foreign exchange.

He noted that the former Imran Khan-led administration “broke off” its agreement with the IMF, and the current government postponed talks with the lender, which resulted in pressure on the rupee.

In relation to the USD, the value of the Pakistani rupee has decreased by almost 26% so far this year (CY22).

In the past 12 sessions, the dollar has appreciated 8.12 percent vs the rupee, 36.5 percent since its May 14 CY21 top, and 13.9 percent since the beginning of the current fiscal year (FY23).

To date, the administration has not been able to organize dollar inflows to strengthen the nation’s dwindling foreign exchange reserves on a weekly basis. The $1.2 billion IMF loan infusion was insufficient to persuade other creditors to adopt the Fund’s economic assistance plan.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.