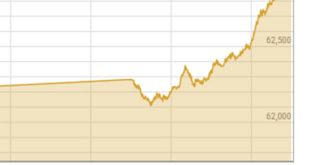

Friday’s interbank market morning trading saw the PKR lose Rs1.1 vs. the dollar, ending a three-day winning run.

Data from the Forex Association of Pakistan shows that at 11:45 am, the local currency was trading at Rs 219.7 per US dollar.

The primary cause of the rupee’s devaluation, according to Saad bin Naseer, director of the financial data and analytics site Metis Global, was the increase in the dollar index and the strengthening of the US dollar in the global currency market.

“We’ve managed our current account deficit. The PKR will strengthen during the next few days. The movement per dollar will be between Rs. 219 and Rs. 222. This is not out of the ordinary, he said.

According to Reuters earlier today, the dollar was poised to record its third consecutive week of gains versus the euro and yen, and it was trading close to its best levels in decades.

Overnight, the dollar index reached a two-decade high of 109.99 and closed at 109.51. Since US Federal Reserve Chair Jerome Powell shocked investors by stating that high interest rates will be necessary “for some time” to contain inflation, the market has gained more than 1%.

Zafar Paracha, General Secretary of the Exchange Companies Association of Pakistan (Ecap), said that pressure on the import bill and an increase in smuggling to Afghanistan were the reasons for the rupee’s collapse.

He pointed out that the recent floods had killed animals and damaged residences, industries, and infrastructure, and as a result, the government had eliminated tariffs on goods given to flood victims. To lessen shortages, the nation also began importing veggies right away.

According to Paracha, all of this would have an impact on the import bill, as would the government’s easing of the restriction on the import of luxury and non-essential goods.

Notwithstanding the efforts of law enforcement, smuggling has escalated, according to the general secretary of ECAP. “We must put an end to the smuggling of cash at airports and borders with Afghanistan and Iran. Agencies should announce a 50% reward for capturing that smuggling cash. He hinted, “Things will get under control.”

According to Paracha, there has been a rise in the smuggling of goods on which the government has placed heavy regulatory charges, which has raised the demand for dollars.

Additionally, he demanded that the transit trade arrangement with Afghanistan be reviewed since he believed it was “eating up” Pakistan’s earnings and foreign cash.

According to preliminary statistics released by Pakistan Customs on Thursday, the import bill decreased by 13.5 percent in August from $6.59 billion to $5.7 billion in the same month the previous year.

Imports fell 12.81 percent to $4.86 billion in July, compared to $5.57 billion in the same month the previous year.

Every month, the import bill went up by 17.28 percent.

On July 28, the rupee hit a record low of 239.94. After that, it bounced back for 11 straight sessions, ending on August 16 at Rs213.90 in the interbank.

But on August 17, the local currency began to decline once again, losing Rs 8.02 until August 29. The rupee had gained against the US dollar for the previous three sessions, but it fell against the US dollar once again today.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.