Ahead of US labor statistics that might support the argument for rapid interest rate rises, investors were in no hurry to sell the dollar, which was poised for its third straight week of gains and hovering around its best levels in decades versus the euro and yen on Friday.

The US dollar rose beyond 140 yen for the first time since 1998, thanks to a strong manufacturing report released overnight. It also reached multi-year highs vs. the Kiwi and pound.

The euro dropped below parity against the strengthening dollar, hitting $0.9967, not distant from the 20-year low of $0.99005 set last week. In the Asia session, the yen hit a new low of 140.4.

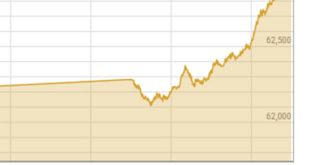

Overnight, the dollar index reached a two-decade high of 109.99 and closed at 109.51. Since Federal Reserve Chair Jerome Powell shocked investors by stating at Jackson Hole, Wyoming, that high-interest rates would be necessary “for some time” to manage inflation, the market has gained more than 1%.

With the overnight drop, sterling has lost almost 1.5 percent this week. After briefly reaching $1.1499 overnight, it was last at $1.1551.

Both the Australian and New Zealand dollars have decreased by almost 1% this week; the Australian closed at $0.6789, while the Kiwi hit its lowest level since May 2020 at $0.6051.

According to Steve Englander, director of G10 FX analysis at Standard Chartered, “We had thought that the slowing of the economy would be enough to pause Fed hiking by November, but Powell’s clear nod to restrictive policy points to a higher bar to a pause.”

“We believe a significant slowdown in US labor data would be necessary to prevent a policy rate hike of 75 basis points,” he said.

The non-farm payrolls report is scheduled for release at 12:30 GMT. According to experts, 300,000 new jobs were created in August, extending a positive trend of data. According to Englander, a surprise much below 275,000 would be required to alter the rates forecast.

Due to a week of intense selling in the Treasury market, two-year yields have increased by 12 basis points and 10-year yields by 23 basis points. Fed funds futures are pricing in around a 75% likelihood that the Fed will raise rates by 75 basis points this month.

Overnight, the 10-year yield reached a 2.5-month high of 3.297pc, while the two-year yield reached a 15-year high of 3.551pc.

Because Japan’s rates are fixed at zero, the actions have bolstered the dollar’s advance against the yen.

According to Chief Cabinet Secretary Hirokazu Matsuno, Japan’s government was closely monitoring currency movements on Friday.

Fresh COVID-19 lockdown measures in Chengdu were putting pressure on the Chinese yuan, which was also under strain elsewhere in Asia, where it was trading at 6.907 per dollar.

Next week sees European and Australian central banks meet, and the markets anticipate rate increases. Traders estimate that there is a 60% probability of a 50 basis point increase in Australia and a nearly 80% possibility of a 75 basis point increase from the Fed.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.