On Friday, the dollar stayed close to its recent highs as Treasury yields rose on predictions that the US Federal Reserve will need to raise interest rates further to control inflation.

Overnight, the offshore yuan saw its first move over seven per dollar in almost two years due to the strong dollar, with the yuan reaching a low of 7.035 in trading with Asia.

The onshore unit, which last traded at 7.009 per dollar, also breached the crucial threshold shortly after the markets began on Friday.

China’s economy proved remarkably resilient in August, according to data released on Friday. Both manufacturing production and retail sales increased last month more than anticipated. However, a worsening real estate market cast doubt on the future. Even while there may be occasional retreat, “growth and policy divergence between the US and China could continue to support the USDCNH in the coming months,” according to Maybank analysts, who also pointed out some “upside surprises” in the Chinese data release.

The Australian dollar, which is often regarded as a liquid stand-in for the yuan, fell to $0.668 two months ago before rising 0.28 percent to $0.672.

Similarly, the kiwi dropped to $0.596, its lowest point since May 2020, and recently traded up 0.23 percent to $0.598.

With the GBP down 0.03pc at $1.147, the euro was up 0.05pc at $0.999.

The Federal Reserve, the Bank of Japan (BOJ), and the Bank of England will all be holding monetary policy meetings next week, and the Fed will likely take center stage.

US retail sales surprisingly increased in August, according to statistics published overnight, while initial applications for state unemployment benefits decreased by 5,000, according to a separate Labor Department report that also caused a rise in US Treasury rates.

A leading indicator of future interest rates, the US Treasury yield on two-year notes reached a record high of 3.901 percentage points on Friday, the highest level since 2007. Fed funds futures indicate a 75% likelihood of a rate rise of 75 basis points at the meeting the following week and a 25% possibility of an increase of 100 basis points.

This may cause further suffering for the weak Japanese yen, which has already suffered from the rising value of the US dollar and widening interest rate differences.

However, according to three people with knowledge of the BOJ’s inner workings, the central bank has no plans to boost interest rates or modify its dovish policy guidelines to support the yen.

Despite being 0.09 percent weaker than the yen at 143.36, the dollar was still expected to rise for a sixth consecutive week.

The dollar will continue to strengthen, at least for the foreseeable future. Since the two main pillars of the US dollar’s support are still in place, market pricing for the FOMC is quite aggressive. furthermore, there is a decreasing prospect for worldwide expansion,” said Carol Kong, a senior associate at Commonwealth Bank of Australia’s division of international economics and currency strategy.

“The US dollar can stay strong and possibly even rise slightly as long as the outlook for the global economy is still bleak.”

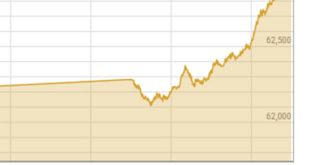

Nearing its two-decade top of 110.79, the US dollar index strengthened to 109.69.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.