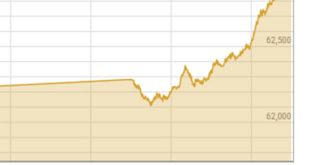

Ever since June, the costs of necessities have risen at a dizzying rate. With the elimination of energy subsidies and the imposition of fuel taxes and levies, the CPI has increased by almost 13% in the last three months.

According to financial experts, the typical time it takes for the inflation index to rise by this much is between twelve and eighteen months. The third-fastest rise in consumer goods and services prices since April 1975 and the fifth-fastest since October 1973 occurred in August when inflation skyrocketed to an almost 50-year high of 27.3 percent.

Due to the floods that have devastated the nation, destroyed communication infrastructure, and washed away crops and ready-to-eat food, the new prices don’t even begin to cover the effect on food and non-food inflation.

Projections indicate that the cost of living will increase even more over the next several months once the impact of the deluge is factored in. Last month, transportation costs increased by 63%, food by 31%, housing and utilities by 27.6%, apparel and footwear by 17.6%, education by 10%, and health by 11.8 %.

Editorial: The rising cost of food

Over the next few weeks, the effects of this year’s devastating floods on the economy and the people will show. Both the International Monetary Fund and the State Bank had predicted average inflation for the current fiscal year of 19.9 percent; however, after the economic effect of the disaster is wholly reflected in their new estimates, the State Bank may have to raise its projections to 22 to 24 percent.

Since no amount of statistics, no matter how precise, can adequately portray the people’s suffering, price inflation—particularly food inflation—should, therefore, be the government’s primary focus.

The buying power of the middle class has been significantly diminished in recent years due to rampant inflation, which has drained their already thin reserves, thrown their household budgets into disarray, and impacted their budgets negatively. The people have a right to be protected and given respite from the escalating living expenses.

Now that the IMF program is back on track, Miftah Ismail, the country’s finance minister, can concentrate on lowering inflation. Given the devastation caused by the rains and floods and the unpredictability of the global economic climate, no one is claiming that the task will be simple. However, the public will remember him more for his work in this area than for resurrecting the IMF accord in the long run.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.

Pakish News We are an interactive media group that here a purpose to update users with the latest information. Our mission is to give you knowledge not only about your surroundings. We will also update you around the Globe.